Company formation

In Denmark, the most common business structures are the Private Limited Company (ApS) and the Public Limited Company (A/S). Each offers distinct advantages, with the main differences being the required capital and management complexity. An ApS requires less capital and is simpler to manage, while an A/S involves higher capital and stricter regulations, suited to larger enterprises.

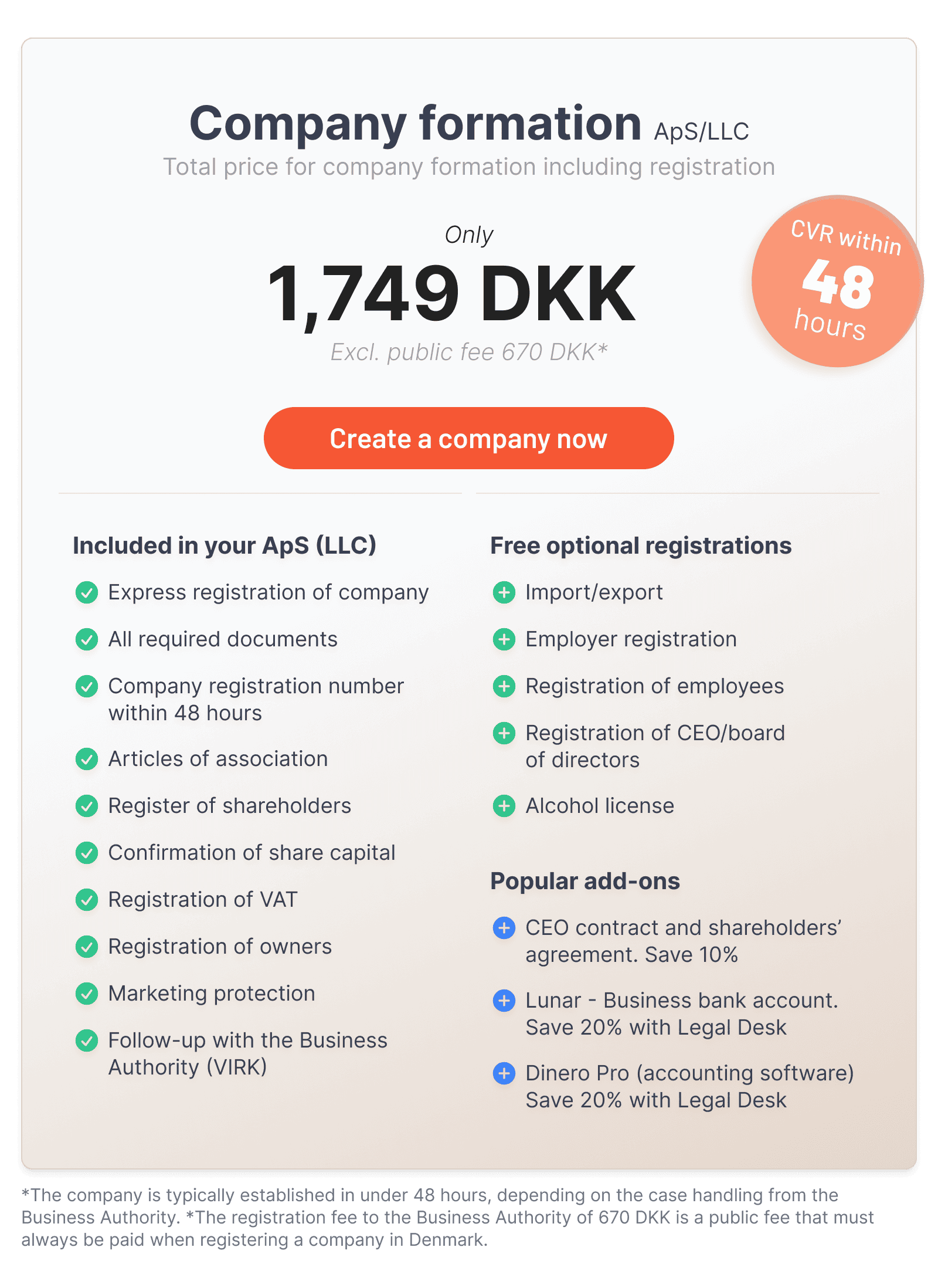

1.749,-

Excl. VAT

Spar kr. 4.000,-

Ift. traditionel advokat

10-15 min.

I reelt tidsforbrug

Company formation

Everything gathered in one place

CVR registration within 48 hours

Complete documentation package, including shareholder register and articles of association

Includes confirmation of share capital

More than 60.000 entrepreneurs have chosen Legal Desk

We form 30% of all private limited companies (ApS) in Denmark

Excl. mandatory fee to the Danish Business Authority of 670,-

Legal Desk benyttes af over 275.000 virksomheder, selvstændige, private og samarbejdspartnere!

1.749,-

Excl. VAT

Spar kr. 4.000,-

Ift. traditionel advokat

10-15 min.

I reelt tidsforbrug

Company formation

Everything gathered in one place

CVR registration within 48 hours

Complete documentation package, including shareholder register and articles of association

Includes confirmation of share capital

More than 60.000 entrepreneurs have chosen Legal Desk

We form 30% of all private limited companies (ApS) in Denmark

Excl. mandatory fee to the Danish Business Authority of 670,-

Start Your Business with Legal Desk

Legal Desk is responsible for establishing 24% of all limited companies in Denmark. Our products are developed by legal experts, and our customer service team is available to assist you every step of the way. Additionally, we offer a range of supplementary products to support your business needs, including CEO contracts, NDAs, insurance, and more.

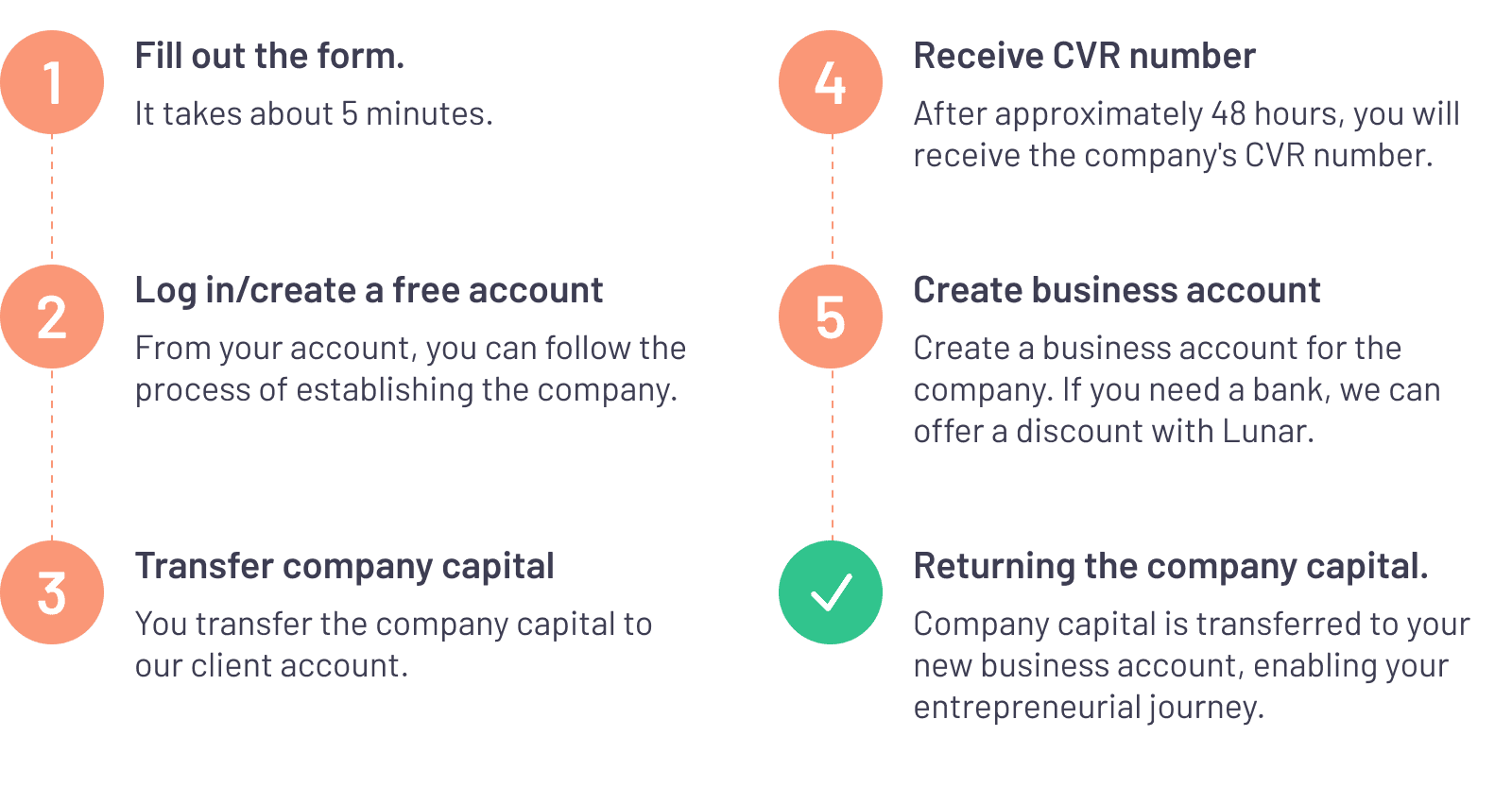

Process for Company Formation

It usually takes less than 24 hours to establish a company with Legal Desk. The process is simple, and you can track progress directly from your profile to stay constantly updated. We’ll also send you regular updates as the company formation progresses.

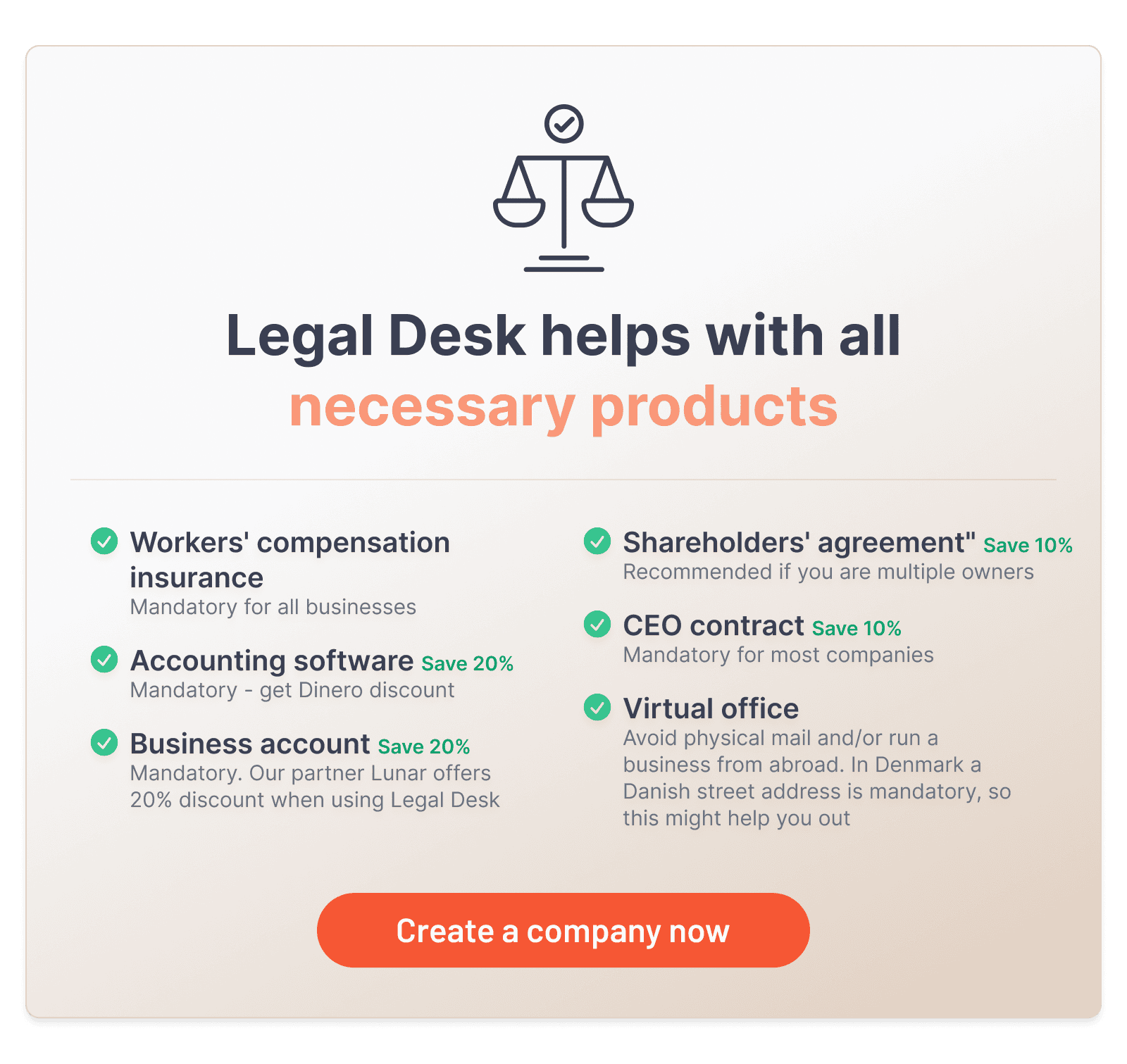

Exclusive Discounts with Legal Desk

Legal Desk partners with several leading providers of mandatory products—such as accounting software, insurance, and business accounts—that all business owners need. As a result, you can receive discounts on these products when you choose to set them up through Legal Desk.

Track Your Case Online

With Legal Desk, you can track your case online at any time. We will also keep you updated via email whenever there is new information regarding your case.

ApS - Private Limited Company

A Private Limited Company (ApS) is the most popular business structure in Denmark, valued for its flexibility and low capital requirements, making it ideal for entrepreneurs and small business owners seeking limited liability and a straightforward setup.

Key Features of an ApS:

- Limited Liability: Owners are only liable for the capital they invest, protecting personal finances. The minimum share capital is DKK 20.000, and creditors can only claim the company’s assets, not personal ones.

- Independent Legal Entity: An ApS is a separate legal entity, with its own rights and obligations distinct from its owners.

- Flexible Ownership: Shares in an ApS are easily transferable, facilitating the addition of new investors or co-owners.

Establishing an ApS:

Setting up a Private Limited Company (ApS) online through Legal Desk is quick and straightforward. Here’s a step-by-step guide:

- Online Form: Complete a form with basic company details, typically in about 10 minutes.

- Automatic Document Generation: Legal Desk generates essential documents for your ApS, including the Certificate of Incorporation, Articles of Association, and Ownership Register.

- Digital Signing: Once the documents are ready, you and any co-owners sign them digitally using MitID.

- Official Registration: Legal Desk registers your company with the Danish Business Authority. After capital verification, your ApS is officially established.

Documents Required for an ApS:

- Certificate of Incorporation: Contains essential details about the company, including ownership stakes and management structure.

- Articles of Association: Establishes the company’s internal rules, covering decision-making processes and the financial year.

- Ownership Register: Documents the distribution and ownership of company shares.

A/S - Public Limited Company

A Public Limited Company (A/S) is a larger corporate structure in Denmark, commonly chosen by established businesses or those seeking to raise significant capital. Unlike a Private Limited Company (ApS), an A/S requires a higher minimum capital investment and involves a more complex governance structure.

Key Features of an A/S:

- Higher Capital Requirement: Establishing an A/S requires a minimum capital of DKK 400,000, a more substantial financial commitment than an ApS.

- Mandatory Board Structure: An A/S must have both a board of directors and an executive board, adding governance requirements not applicable to an ApS.

- Limited Liability: Similar to an ApS, owners are liable only for the capital they invest, ensuring personal assets remain protected from creditors.

- Enhanced Credibility: The higher capital threshold and formal governance structure convey stability and professionalism to investors, suppliers, and business partners.

Process for Establishing an A/S:

Setting up a Public Limited Company (A/S) through Legal Desk involves a few additional steps compared to an ApS:

- Complete the Online Form: Provide details about the company’s structure, including capital contributions and the mandatory board members.

- Receive Documents: After completing the form, key documents for the A/S—such as the Certificate of Incorporation, Articles of Association, and Ownership Register—are automatically generated.

- Digital Signing: All required parties, including board and executive board members, must sign the documents digitally using MitID.

- Registration: Legal Desk registers the A/S with the Danish Business Authority and completes the share capital verification.

Documents Required for an A/S:

- Certificate of Incorporation: Officially records the company's formation, detailing capital contributions and management structure.

- Articles of Association: Outlines the rules that govern the company's management and operational procedures.

- Ownership Register: Tracks the distribution of ownership shares among founders and investors.

Holding Structure

A holding structure is not a distinct legal entity type; rather, it refers to a company (such as an ApS or A/S) primarily established to own shares in other companies. Essentially, it serves as an intermediary layer between you, the owner, and the business entity (also an ApS or A/S, for example) that handles day-to-day operations.

In a typical holding structure, you own the holding company, which, in turn, owns the operating company that conducts the actual business activities.

Key Features of a Holding Structure:

- Limited Liability: As a separate legal entity, a holding company protects its owners’ personal assets from any liabilities incurred by the company. The extent of this protection depends on whether it’s structured as a Private Limited Company (ApS) or a Public Limited Company (A/S).

- Tax-Free Dividend Transfers: When a holding structure owns more than 10% of an operating company, dividends can be transferred to the holding company without incurring the typical 27%–42% dividend tax, significantly enhancing tax efficiency.

- Tax-Free Business Sale: Selling a business through a holding structure allows for a tax-free transaction, in contrast to personal sales, which are subject to capital gains tax. This structure can provide substantial tax advantages upon exit.

- Simplified Ownership Transitions: Holding structures streamline ownership changes, as retained profits remain within the holding entity. Additionally, tax-free dividends increase liquidity, making buyouts and transitions smoother and more cost-effective.

Process for Establishing a Holding Structure

Setting up a holding company with Legal Desk is straightforward. Here’s a step-by-step guide:

- Complete the Online Form: Provide essential information about the holding company, including ownership structure and capital contributions, via Legal Desk’s online form.

- Receive Required Documents: Once the form is completed, Legal Desk automatically generates the necessary documents for establishing the holding company.

- Digital Signing: All involved parties, such as co-owners, digitally sign the documents using MitID, ensuring secure and efficient authorization.

- Registration: Legal Desk registers the holding company with the Danish Business Authority (Erhvervsstyrelsen) and completes the required capital verification process.

- Receive CVR Number: After registration, you’ll receive a CVR number, officially establishing the holding company and enabling you to manage your ownership interests.

Documents Required for a Holding Company

- Certificate of Incorporation: Confirms the company’s formation details, including its registered name, date of incorporation, and legal structure.

- Articles of Association: Defines the company’s internal regulations, covering decision-making processes, management responsibilities, and the fiscal year.

- Ownership Register: Documents the distribution of shares among shareholders, ensuring transparency and a clear record of ownership.

Key Differences Between an ApS and an A/S:

- Capital Requirements: An ApS has a minimum capital requirement of DKK 40,000, while an A/S requires DKK 400,000.

- Management Structure: An A/S mandates a board of directors and an executive board, whereas a board of directors is optional for an ApS.

- Investor Attraction: An A/S is more suitable for companies aiming to raise significant capital, as it facilitates easier share transfers and conveys financial stability.

- Credibility: With its higher capital requirement and more complex structure, an A/S generally conveys a greater level of credibility, particularly for larger operations.

Choosing between an ApS and an A/S largely depends on the scale of your business and your growth ambitions. An ApS is ideal for small and medium-sized enterprises due to its flexibility, lower capital requirements, and simplified management. In contrast, an A/S is better suited for larger businesses that need substantial capital and seek to attract investors. Both structures provide the benefits of limited liability and function as independent legal entities, offering protection and growth potential for entrepreneurs in Denmark.

OBS. Du skal ikke foretage dig noget for at få virksomhedstjekket. Det sker automatisk, når du køber et erhvervsprodukt hos Legal Desk.

Ofte stillede spørgsmål

.

What are the most common business structures in Denmark?

The most common business structures are the Private Limited Company (ApS) and the Public Limited Company (A/S).

What is the minimum capital requirement for an ApS?

The minimum share capital for an ApS is DKK 20.000.

What is the minimum capital requirement for an A/S?

The minimum capital requirement for an A/S is DKK 400,000.

What is the difference between ApS and A/S regarding management structure?

An A/S requires a board of directors and an executive board, while an ApS only requires an executive board – a board of directors is optional.

What is a holding structure?

A holding structure is when a company is established to own shares in other companies, acting as an intermediary layer between the owner and the operating company.

What is a key tax advantage of a holding structure?

When a holding company owns more than 10% of an operating company, dividends can be transferred to the holding company without incurring the typical dividend tax.

What documents are required for establishing an ApS and A/S?

The documents required include the Certificate of Incorporation, Articles of Association, and Ownership Register.

What is the benefit of limited liability in an ApS or A/S?

Owners are only liable for the capital they invest, protecting personal finances from business debts.